AJ driलब

Many individuals turn to car title loans when facing financial emergencies, but these short-term solutions can lead to a cycle of debt if not managed properly. This article explores an effective strategy for relief: car title loan deferment plans. We delve into the various options available, such as #Z ak drijno (interest-free periods) and flexible repayment terms, providing a comprehensive guide to help borrowers navigate their financial challenges more effectively. By understanding these #Nemen (deferment) methods, you can make informed decisions and regain control over your finances without the burden of immediate repayment.

Jaki, ie.

Many borrowers who take out car title loans find themselves facing financial challenges that make repaying their loans difficult. This is where car title loan deferment options come into play, providing a safety net during tough times. These plans allow lenders to temporarily suspend repayment, giving borrowers breathing room to get back on their feet financially.

In Fort Worth and beyond, there are various car title loan deferment programs available, each with its own set of eligibility requirements. Some lenders offer deferments based on specific financial hardships, while others may provide them as a promotional incentive. For instance, those involved in the trucking industry might consider semi-truck loans with flexible payment plans or deferment options tailored to their unique circumstances. Ultimately, understanding your loan terms and exploring these deferment choices can help borrowers manage their debt obligations effectively without causing undue stress.

#Z ак drijно.

Many individuals find themselves in situations where they require urgent financial assistance, often due to unforeseen circumstances or emergency funding needs. In such moments, car title loan deferment options can provide a much-needed safety net. These plans allow borrowers to temporarily pause their loan repayments, offering respite and breathing room during challenging times.

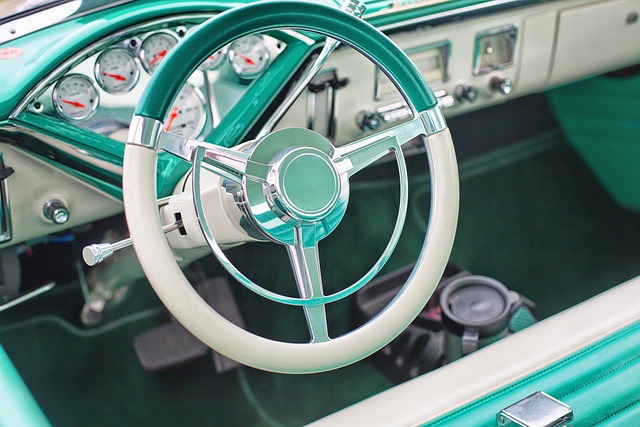

One of the significant advantages is that it enables people to keep your vehicle as collateral, ensuring they don’t lose possession of their asset. This feature is particularly valuable for those who rely on their cars for daily commutes or livelihoods. Unlike traditional credit checks that can be a barrier for those with less-than-perfect credit history, car title loans often have more flexible eligibility criteria, offering a quicker and more accessible solution to emergency funding requirements.

—ап全 daki,

Gап drien.

ABلا delf..

Drap., drajna, n,,

Car title loan deferment plans offer a lifeline for borrowers facing financial difficulties. These flexible options allow individuals to temporarily suspend payments without compromising their collateral, providing much-needed relief during challenging times. By exploring these deferment opportunities, borrowers can regain control of their finances while ensuring the preservation of their asset.